Shooting from the heart: how simple truths and taking chances became a winning actuarial model

For co-founder Alan Greenfield, the Taylor Fry adventure has been a wild ride. As the firm turns 24, he looks back at some of the riskier life moments that led him there, the humanity that drives his passion to do more and his hopes for the future.

When did you know you wanted to become an actuary?

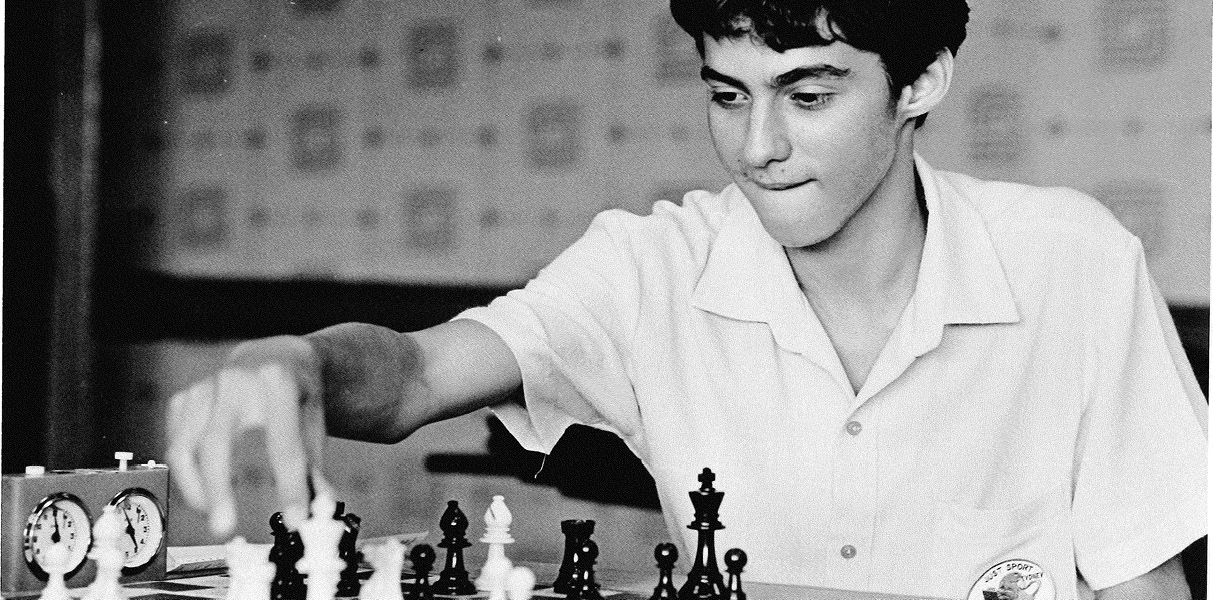

I guess I have always been obsessed with maths, numbers and puzzles. I played chess from age five and loved probability puzzles, magic squares and the Rubik’s Cube. I hadn’t heard of actuaries until year 12, when another student said he wanted to be one. He did four-unit maths, like me, so I looked it up. It was a small profession then, but highly regarded with great job prospects. And as it turned out, a lot of the study and work that followed seemed pretty close to my idea of fun.

Alan played chess from age five and loved probability puzzles, magic squares and the Rubik’s Cube

How did that relaxed approach become entrepreneurial spirit to start a business?

I don’t think of myself as having an entrepreneurial spirit. It’s more about risk taking for me. I’ve noticed since my twenties, I’m willing to take more risks than some people, and that the best things in my life have happened when I’ve taken risks, from off-the-beaten-track experiences while travelling to setting up Taylor Fry.

Taking a risk helps you move ahead. You don’t get far if you’re not willing to risk something – even something small. Not everything will turn out smoothly, but if you try to make the most of the inevitable bumps along the way, I’ve found it’s definitely worth taking the leap.

What was your strength at the beginning?

Probably enthusiasm! The thought of building something from scratch was exciting and fun to me, plus the three of us [Alan and co-founders Greg Taylor and Martin Fry] shared a distaste for process for the sake of process, and too much internal politics. We wanted to right wrongs, make things fair.

Greg and Martin had established reputations, so they mostly took care of bringing in the clients, while I threw myself into finding cheap premises – a long way from our beautiful new offices now – and interviewing and hiring people. I knew the workplace I wanted to create – one with smart people whose focus was the company, not the individual. I even wrote the job ads. I’ve always had an irreverent attitude and I liked to have a laugh with the ads, but we’re a lot more professional these days!

It seems to have paid off because many people have long careers at Taylor Fry. What’s the secret to finding the right fit?

It’s hard to put my finger on it, but there’s definitely something around cultural fit – wanting a balanced approach to work and life – but also something around curiosity and looking for innovative ways to solve problems. We also look to hire people with a variety of backgrounds and diverse perspectives, which adds dimension and strengthens the work we do.

Alan at Taylor Fry's first office in Sydney

How has your role changed over almost two-and-a-half decades?

I gradually became established as an actuary, thanks to Greg, who was always generous about giving people responsibility. I took over some of his major clients and began building a reputation. For many years, I did what is considered ‘traditional’ general insurance actuarial work, for insurance companies and injury schemes. In time, it became my comfort zone. Luckily, I had the right people to help me see that I also needed to push myself harder to expand my horizons and those of the company to help grow the business. It was quite brutal and confronting to hear, but it had a positive effect.

In the mid-2000s, I was involved in building our analytics practice, but in 2011 I had a major role in a project we won that changed everything about my career. It also set Taylor Fry on a course that helped develop us into the organisation we are today. It was a first-in-the-world valuation of a national welfare system at an individual level. We built forecasts of people’s lifetime welfare service use for the New Zealand Ministry of Social Development. Before we knew it, we were presenting to senior government officials, cabinet ministers and the media. It was ground-breaking work and a cornerstone of the development of our now much bigger Government practice. It has been a wild ride. [Alan was awarded Actuary of the Year in 2015 for his role in this work].

I never saw myself as somebody whose day-to-day role would centre on developing and winning business, marketing or networking, but that’s a big part of my contribution these days. My career has really moved away from a lot of the technical work. We have amazing people at Taylor Fry who do all of that, which allows me to focus on making sure we really communicate what the numbers mean for our clients. I still love building spreadsheets though!

At Taylor Fry, we’re now working on developing our actuarial skillset to help clients navigate their climate risk. It’s exciting to take part in finding solutions and in our own way contribute to hope for the future.

You’re also responsible for the firm’s stance on sustainability. What led to your interest?

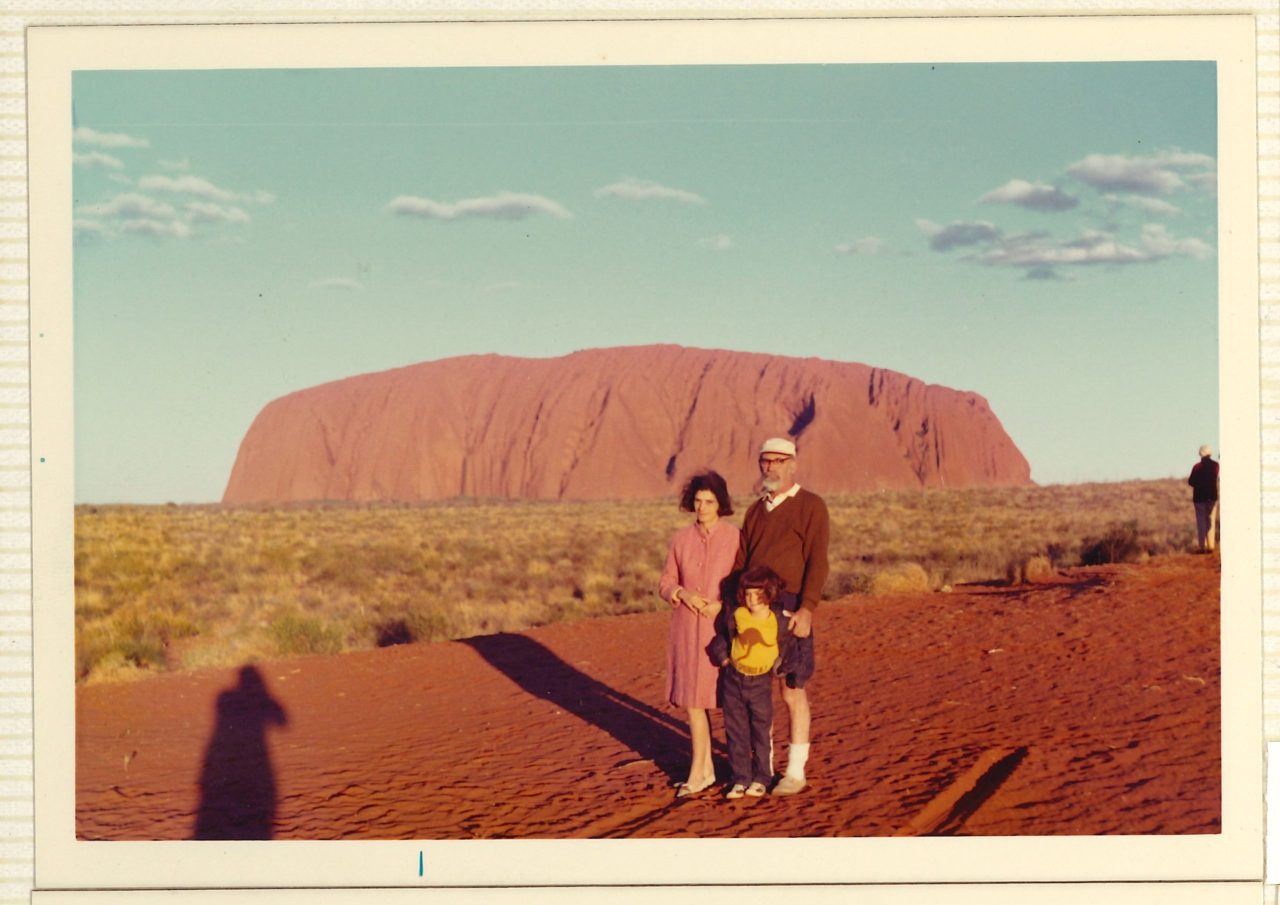

My mother particularly shaped the way I see the world. She had an Eastern European Jewish background, with her family escaping Europe in the 1920s when they realised the writing was on the wall. Like many of her generation, she was deeply impacted by losing relatives in the Holocaust. As a child, I travelled with her throughout Europe, the Middle East, Asia and the United States on trips that mostly revolved around searching for her or my father’s long-lost cousins. But along the way she also introduced me to nature – the Grand Canyon, Swiss Alps, the Great Barrier Reef and Uluru.

Being exposed to travel and nature gave me a love of the natural world. It planted a seed – together with my parents’ histories of losing everything and starting again when they migrated – a real sense of not abusing resources, being compassionate towards others and being frugal to survive.

On a trip to Uluru with his mum and dad, 1972

How did this focus continue into adulthood and into your work?

A back-packing trip to South America changed my life. I was lucky enough to be able to spend almost a year going from Guatemala to Chile and I did things I didn’t expect I’d be physically or mentally capable of doing, like climbing very high, very icy mountains. I travelled with a mate and we had some lucky escapes. We climbed the highest mountain in Peru [Huascarán, 6768m] and while we were there, two well-known rock climbers died. They were caught in a rock avalanche and fell a kilometre to their deaths. It was tragic and shocking.

At another point in the trip, we were stuck in the Amazon jungle in Peru for days. Trying to make our way to Bolivia, we hitched a ride on a canoe full of diesel drums, then slept in a disused police building on the Bolivian border. Eventually, we bought a dugout canoe and a couple of paddles from the locals, and stocked up with a few rusted tins of expired food, a bit of pasta and chocolate, and a handful of plantains, a type of savoury banana.

With no map of the river and no real direction or idea of how long it would take to reach safety, we paddled for five days in the middle of nowhere along the Rio Madre de Dios – the Mother of God River – a tributary of the Amazon. Somehow, we even managed to keep ourselves upright through a stretch of rapids. We were utterly alone, surrounded by wilderness and wildlife. It was spectacular. South America was unforgettable and affected me profoundly.

As a young person in my twenties, that trip, combined with the travels of my childhood, brought into stark relief the impact humans were having on these incredible places I’d experienced. In the 2000s, I started an environmental column in the Actuaries Institute’s magazine (I thought I was very clever in making a play on words with my surname, calling it Green Fields). It was my way of trying to shed light on climate change and the not-fast-enough progress governments around the world were making, including ours. I still believe we’re collectively not making enough progress and, alongside governments, individuals and companies also have a role to play. At Taylor Fry, we’re now working on developing our actuarial skillset to help clients navigate their climate risk. It’s exciting to take part in finding solutions and in our own way contribute to hope for the future.

Alan with his climbing partners on the summit of Pisco in Peru

What makes you most proud about the company you co-founded and what’s the key to its success?

For us, success means creating a place that provides a supportive and growing environment to provide our younger staff with opportunities and give them lots of variety. This ranges from traditional actuarial work with insurance companies and injury schemes to customer analytics for Qantas and other companies. In the social sector, our projects cover everything from welfare and homelessness to disability, mental health, child protection, aged care, and recently projects with a First Nations context. We recently authored an Actuaries Institute green paper that details the economic divide in Australia and paints a shapshot of income inequality. Cyber is a critical concern for organisations today and we’re deeply involved in this area as well. Our work culminated in another Actuaries Institute green paper, for policy and other decision-makers to consider the role of insurance in the cyber environment. This diversity means people can find their niche here and grow in their careers.

Do you think about passing the baton to the next generation? How would you like to see Taylor Fry move forward with you and after you?

The future is incredibly exciting for our younger people. Data can now be used in so many ways for so many different types of organisations, and Taylor Fry is well placed to provide the opportunities for our people in these interesting spaces. Research and development has been encoded in our DNA right from the beginning, with Greg’s use of generalised linear modelling in traditional areas for actuaries to our expansion into analytics in the social sector, and machine learning and AI techniques for our corporate clients. The focus for us has traditionally been on innovating predictive techniques, but for some time we’ve wanted to explore causal links – the underlying story that leads to an event. This means creating models to understand from the data why things happen, in addition to what will happen and when.

Our analytics team has set up an internal working group called TF labs to research this next frontier of advanced analytics, alongside predictive modelling techniques more generally, testing ideas and commercially focused applications. In the labs, one of our projects is designing trials that study problems and aim to identify causal relationships with more certainty. Keeping up this kind of momentum ensures we’re continuing the legacy of our original ideals to chart our own path, steer clear of the bureaucracy as much as possible, look after our people and continue to pioneer in ways that can make a difference to the community.

As for when I’m not here, I’m not sure when that’ll be, but I’m sure the firm and everyone in it will be fine without me!

Enjoyed this read? Take a look at the stories of Taylor Fry’s other co-founders, Greg Taylor and Martin Fry, as they share some choice excerpts and a touch of wisdom from an actuarial life lived.

Recent articles

Recent articles

More articles

Taylor Fry boosts climate expertise

Climate and financial risk specialist Dr Ramona Meyricke rejoins our ranks to lead our climate practice, as we focus on meaningful solutions

Read Article

LA wildfires – implications for the upcoming Australian reinsurance renewals

What are the flow-on effects of the January LA wildfires in Australia?

Read Article