New mandatory climate disclosures – what small to medium insurers need to know

Environment, social and governance (ESG) is driving “the biggest changes to financial reporting and disclosure standards in a generation”, according to Australian Securities and Investments Commission (ASIC) Chairman Joe Longo. First up is climate, with Treasury last week releasing its next consultation paper on proposed mandatory climate-related financial risk disclosures. We explore what these are likely to mean for small to medium insurers in Australia.

Analysis of ASX-listed entities suggests the ‘big end of town’ – including Australia’s major insurers – are relatively well advanced with planning and reporting on climate risks and opportunities. Due to the organisational size threshold outlined in the Australian Treasury’s latest Climate-related financial disclosure consultation paper, if implemented, requirements would also be mandatory for smaller and mid-tier insurers.

Recommended disclosures include how insurers manage climate risk across governance and strategy

This second paper incorporates 194 submissions of feedback from the Treasury’s earlier draft. Consultation for the initial paper closed in March and, as we reported at the time, it sought views on design and implementation of standardised, internationally aligned requirements for disclosure of climate-related financial risks and opportunities in Australia.

Now the Treasury’s second draft sets out proposed positions on the detail, implementation and sequencing of mandatory disclosures. We answer key questions smaller and mid-tier insurers will be asking …

Will mandatory disclosures likely apply to my organisation?

Yes, if additional thresholds are final, most insurers will meet the criteria. The Australian Government has committed to applying standard climate-related financial disclosure requirements to large businesses. The latest consultation paper has proposed that entities lodging financial reports under Chapter 2M of the Corporations Act that meet two of the following criteria would need to comply:

- The consolidated revenue for the financial year of the company and any entities it controls is $50 million or more

- The value of the consolidated gross assets at the end of the financial year of the company and any entities it controls is $25 million or more

- The company and any entities it controls have 100 or more employees at the end of the financial year.

In addition, all entities that are registered as a ‘controlling corporation’ reporting under the National Greenhouse and Energy Reporting Act 2007 (Cth) (NGER Act) would be covered under climate-related risk disclosure requirements, even if they don’t meet the threshold criteria above.

This means most insurers will likely be covered. For comparison, in other jurisdictions, climate disclosures are currently mandated only for larger insurance companies:

- In the United Kingdom, with more than 500 employees

- In New Zealand, with greater than $1 billion in total assets under management or annual gross premium income greater than $250 million).

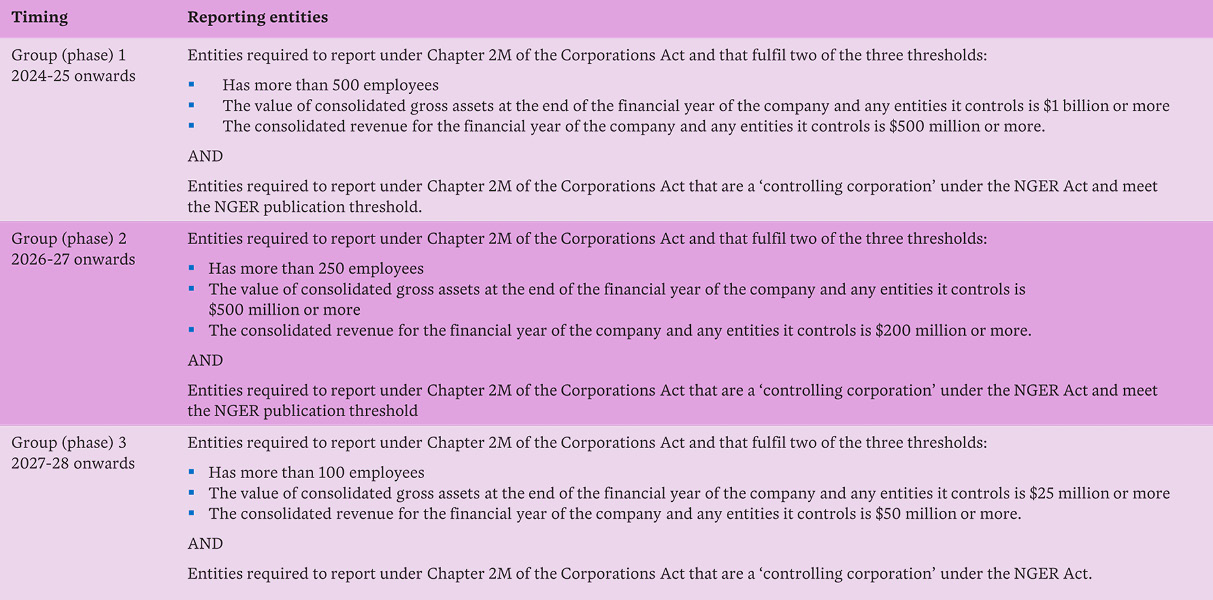

When might mandatory disclosures apply to my organisation?

It will depend on the exact size of your organisation, but medium sized insurers will most likely need to start disclosure in 2026/27, with smaller insurers the year after.

This phased approach is in response to stakeholder feedback. The disclosure regime will start with a limited group of very large entities, and be expanded over two years to apply to progressively smaller entities, with the rationale that smaller entities will need more lead time to build the capability and skills to meet their obligations.

The following table outlines the proposed phasing for mandatory climate disclosures, which entities are covered and when.

Medium sized insurers will likely start disclosure in 2026/27, with smaller insurers the next year

What will we be required to disclose?

At a high level, the climate disclosures are expected to closely align with the final IFRS S2 Climate-related Disclosures, recently released by the International Sustainability Standards Board (ISSB). This standard follows the framework of the Taskforce on Climate-related financial disclosures (TCFD), which recommended companies make disclosures about how they manage climate-related risks and opportunities across:

- Governance

- Strategy

- Risk management

- Metrics and targets (including greenhouse gas (GHG) emissions).

The Australian Accounting Standards Board (AASB) will be responsible for developing Australian-specific standards, and will conduct a public consultation process as part of developing our standards.

How do the mandatory disclosure standards compare with APRA’s Prudential Practice Guide CPG 229 Climate Change Financial Risks?

For those insurers who have implemented APRA’s CPG 229 Climate Change Financial Risks, the four categories of disclosure will be familiar. CPG 229 also reflects the framework for managing risk developed by the TCFD. This means insurers who have been applying this prudential practice guide to their organisation’s climate risks and opportunities should be in a strong position to respond to requirements for mandatory climate disclosures.

What type of scenario analyses will my organisation likely need to perform?

The Treasury’s discussion paper proposes that reporting entities will be required to use qualitative scenario analysis to inform their disclosures during the transition period, moving to quantitative scenario analysis by the 2027-28 reporting year (i.e. the end of the transition period).

The TCFD defines scenario analysis as a process for identifying and assessing the potential implications of a range of plausible future states under conditions of uncertainty. For climate change, scenarios allow an organisation to explore and develop an understanding of how various combinations of climate-related risks, both transition and physical risks, may affect its businesses, strategies and financial performance over time.

In the case that an organisation is already undertaking quantitative scenario analysis, the expectation is that they should continue to do so. In the transition period, the Treasury expects the level of sophistication of this scenario analysis to be proportionate to the experience of the reporting entities, their exposure to climate-related risk and the availability of supporting information (methodology and datasets).

“… scenarios allow an organisation to explore how combinations of climate-related risks, both transition and physical risks, may affect its businesses, strategies and financial performance over time.”

Notably, it’s proposed that companies will be afforded protection from false or misleading representation claims from private litigants related to forward looking statements (such as the results of scenario analysis) for the first three years. This doesn’t rule out regulator actions.

How many scenarios will we need to consider as part of our scenario analysis?

The discussion paper’s proposal is that reporting entities would be required to disclose climate resilience assessments against at least two possible future states, one of which must be consistent with the global temperature goal set out in the Climate Change Act 2022 – which is designed for Australia to contribute to “holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels” (in line with the Paris Agreement’s global temperature goals). Reporting entities would be required to report against at least one other scenario that reflects a different climate future.

What GHG emissions will I need to disclose?

Reporting entities will need to:

- From commencement, report on scope 1 and scope 2 emissions

- From their second reporting year onwards, report on scope 3 emissions.

As a refresher, scope 1 are direct GHG emissions that occur from sources that are owned or controlled by the company (e.g. emissions from combustion in owned or controlled vehicles). Scope 2 are emissions from the generation of purchased electricity consumed by the company, and scope 3 are all other indirect emissions.

For the reporting of scope 3 emissions:

- These are anticipated to be mostly estimates in the immediate term, reflecting available information, and potential lack of internal capability to undertake scope 3 estimation to a high level of sophistication.

- In recognition of the significant data availability issues, the application of misleading and deceptive conduct provisions would be limited to regulator-only actions for the first three years. This is to allow organisations to build capability of calculation and estimation.

- These can have accrued in any one-year period that ended up to 12 months prior to the current reporting period (e.g. scope 3 emissions reported in FY2027-28 could be those incurred (actual or estimated) in the company’s supply chain in FY2026-27, which recognises that other reporting entities’ scope 1 and scope 2 emissions may form inputs for an entity’s scope 3 estimation). The discussion paper has noted this is particularly important for insurers.

Will I need to report on insurance-industry-specific metrics?

Yes. By the 2027-28 reporting year onwards, the Treasury is anticipating that reporting entities would be required to disclose industry-based metrics. These would be subject to consultation with members of that sector.

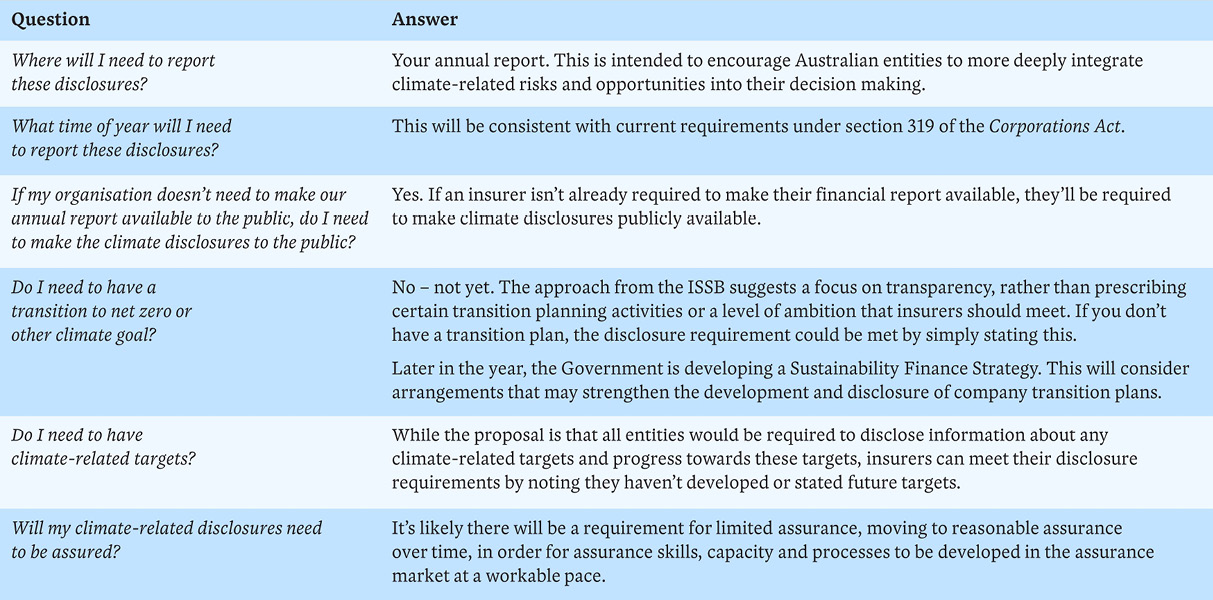

What else do I need to know?

We’ve summarised other key points from the discussion paper in the following table. Bear in mind, these could change after stakeholder feedback.

In asking the right questions, organisations will be better prepared for climate risk reporting

What are the next steps?

The Treasury is looking for feedback on this consultation draft by 21 July 2023, specifically whether the proposed positions relating to coverage, content, framework and enforcement of the requirements are workable. Insurers should consider making a submission, either individually or as part of the Insurance Council of Australia, to ensure the views of smaller insurers are incorporated into the final design.

We’ll be sure to keep you posted on the final design and what that means for insurers.

With more than 20 years’ experience partnering with the insurance industry, and a team of climate risk specialists, Taylor Fry can help insurers think strategically about their response to climate change, including applying our well-honed skills in forecasting uncertain risks. For more information on the services we offer, visit our Climate and Sustainability page.

Other articles by

Sarah Wood

Other articles by Sarah Wood

More articles

Building cyber resilience – 4 critical steps for boards

How can organisations avoid the increasing threat of cyberattack? We joined a recent Actuaries Institute discussion and offer some key steps

Read Article

Climate change: key considerations for general insurers

With extreme weather taking a devastating toll in Australia and New Zealand, we look at what a changing climate means for insurers ahead

Read Article

Related articles

Related articles

More articles

LA wildfires – implications for the upcoming Australian reinsurance renewals

What are the flow-on effects of the January LA wildfires in Australia?

Read Article

RADAR FY2024 – Strongest result in more than 10 years, but insurers in regulator sights

RADAR FY2024, Taylor Fry’s annual insurance rundown in a year of solid results alongside a focus on integrity, customers and climate.

Read Article